Integrations with popular blockchains and Web3 marketplaces to quickly connect Crypto Tax Defenders to your existing systems.

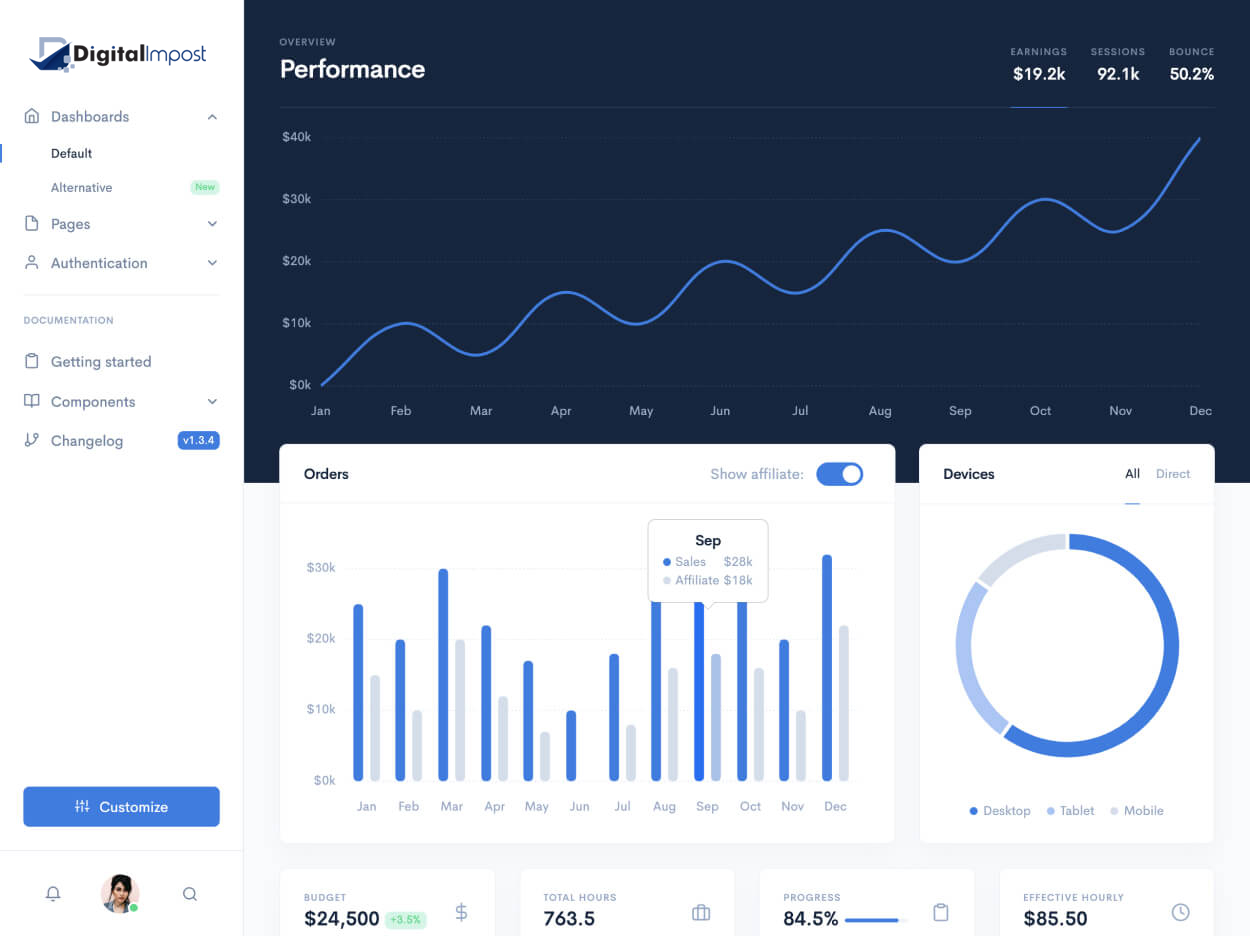

Our Nexus Insights Dashboard and notifications help you stay ahead of your NFT sales tax responsibilities, so you never miss a state filing.

Our real-time calculation engine and sales tax API provides product-specific sales tax calculations in your native cryptocurrency to ensure compliance and a smooth user experience.

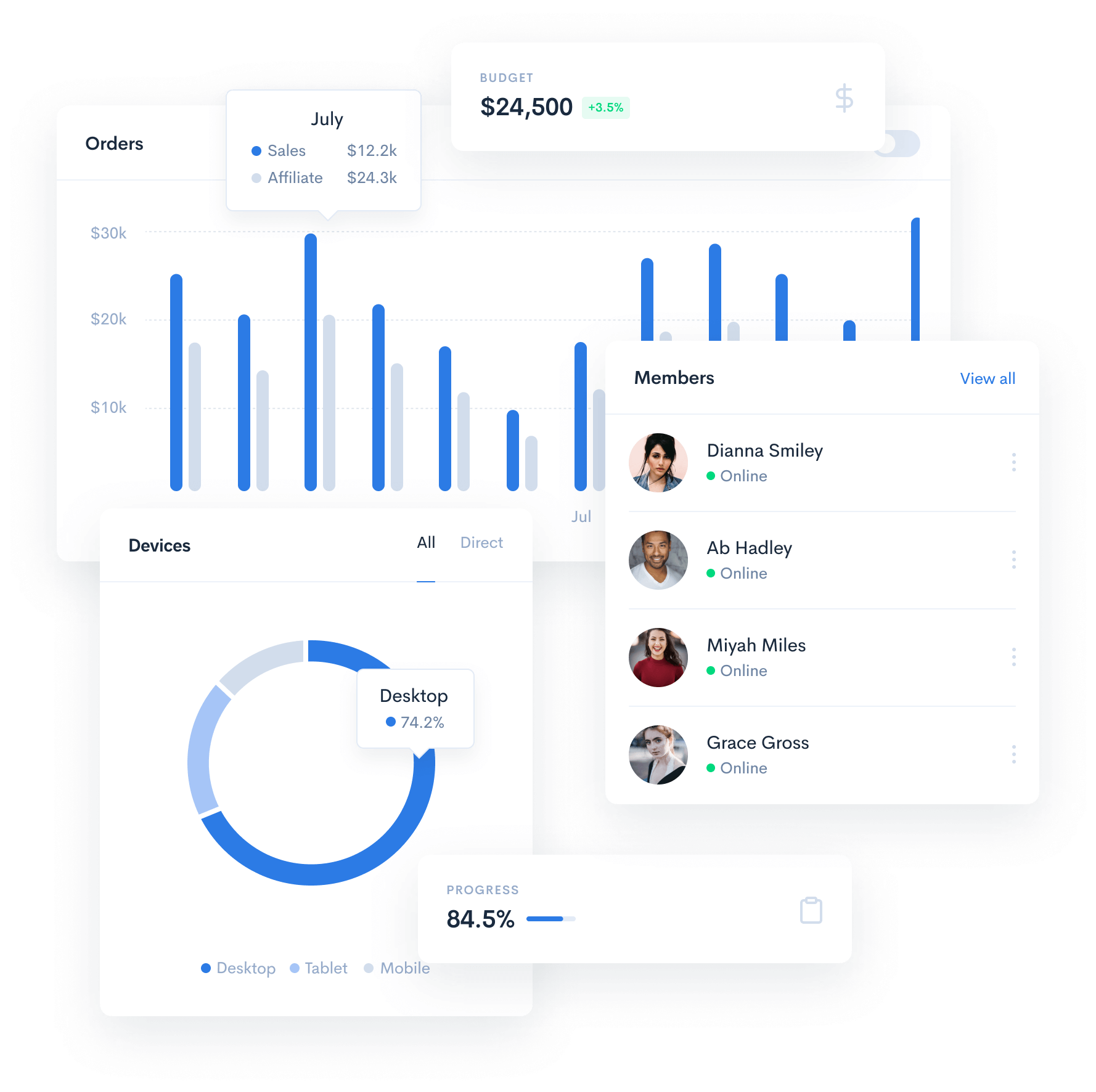

Our reporting dashboard compiles data from all your blockchains and sales channels to give you the most up-to-date view of your detailed transactions and sales tax liability.

Crypto Tax Defenders prepares and submits an accurate return and remittance for each state in which you’re enrolled.

Our Nexus Insights Dashboard and notifications help you stay ahead of your NFT sales tax responsibilities, so you never miss a state filing.

Our reporting dashboard compiles data from all your blockchains and sales channels to give you the most up-to-date view of your detailed transactions and sales tax liability.

Integrations with popular blockchains and Web3 marketplaces to quickly connect Crypto Tax Defenders to your existing systems.

Our real-time calculation engine and sales tax API provides product-specific sales tax calculations in your native cryptocurrency to ensure compliance and a smooth user experience.

Crypto Tax Defenders prepares and submits an accurate return and remittance for each state in which you’re enrolled.

As an NFT seller or artist or Web3 business, you may be wondering why you have to collect sales tax on your digital assets. The reason is simple: NFTs are considered digital goods by the majority of states in the US, and sales tax applies to digital goods just as it does to physical goods.

Several states, including Washington, Wisconsin, Pennsylvania, Minnesota, and Puerto Rico, have provided guidance stating that sales tax should be collected on NFT sales. It’s important to note that the list of states requiring NFT sales tax is constantly evolving, with new states joining the list each year. By collecting sales tax on your NFT sales, you ensure compliance with state and local tax laws, mitigating legal and financial risks that could arise from non-compliance.

Crypto Tax Defenders, an NFT sales tax software, is specifically designed to simplify the tax collection process for NFT sellers and artists. By using our software, you can automate the sales tax calculation and collection, ensuring compliance and peace of mind.

If you’re an NFT seller, it’s crucial to understand which states impose sales tax on NFT sales. While sales tax laws can vary from state to state, currently, many states require NFT sellers to collect and remit sales tax on their transactions. Some of the states that impose NFT sales tax include Washington, Wisconsin, Pennsylvania, Minnesota, and Puerto Rico.

However, it’s important to stay up-to-date with sales tax requirements in the states where you sell, as the list of states requiring NFT sales tax can change over time. Crypto Tax Defenders can help you manage and comply with sales tax requirements for NFT sales, ensuring that your tax compliance is taken care of while you focus on growing your business.

Sales tax on NFTs is typically collected from the customer at the point of sale. The frequency of filing and remitting sales tax varies by state. Some states require monthly filings, while others may require quarterly or yearly filings. It’s important to familiarize yourself with the specific filing and remittance requirements in the states where you have sales to ensure timely compliance.

When selling NFTs and collecting sales tax, it’s important to gather the necessary information from your customers. This typically includes the customer’s location (to determine the applicable sales tax rate and jurisdiction) and any exemption certificates, if applicable. Crypto Tax Defenders’s software can assist you in collecting and organizing this information, making the process seamless and efficient.

Marketplace facilitator responsibilities for NFT sales tax can vary by state, as each state has its own sales tax laws. In most cases, marketplace facilitators are required to collect and remit sales tax on behalf of their sellers. However, the specifics can vary from state to state.

Some states require marketplace facilitators to collect and remit sales tax on all sales made through the marketplace, while others may have criteria such as a certain level of sales or presence in the state. It’s important for sellers to be aware of the sales tax laws in the states where they have sales and ensure compliance with those laws.

Crypto Tax Defenders recommends consulting with a tax professional or lawyer to understand your obligations when it comes to sales tax and marketplace facilitator laws. It’s crucial to stay informed about any changes in these laws to ensure ongoing compliance.